Roi roa roe formula

Legend Principal Manual Input Annual Interest Rate ï alculated Compounding Periods per Year Years Formula. Rentabilidad sobre los activos ROA 12.

Return On Assets Roa And Return On Equity Roe Fundamental Analysis Youtube

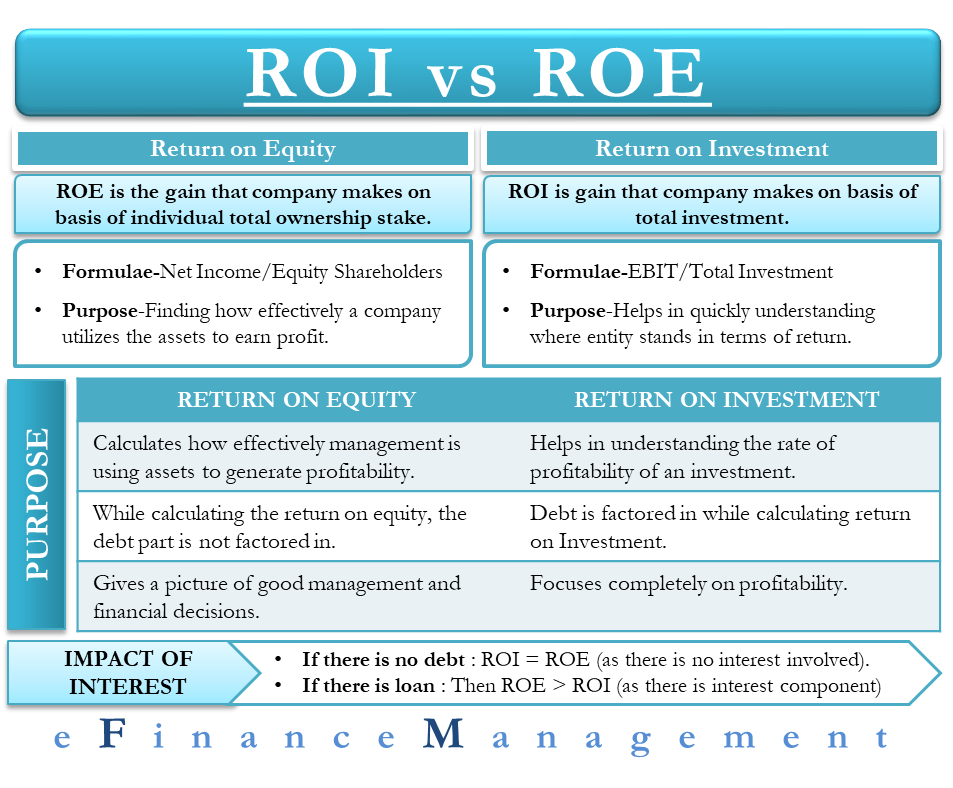

Return on investment is a ratio that evaluates how efficient a certain investment isIt is the obligatory starting and finishing point for any ambitious investor as it presents the potential of a future deal and the end results of a finished one in simple numbers.

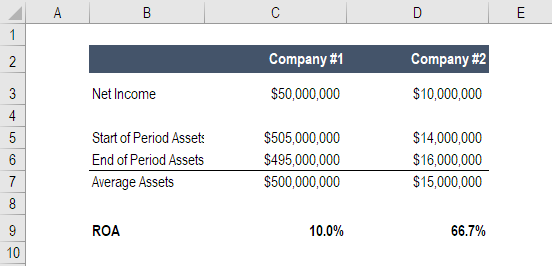

. Embora tenha um nome mais parecido. Measures a companys profit for every 1 of assets it owns. Honda Motor Co Ltd.

ROI - Practical Examples ROI Formula. È un indice di percentuale per il quale il reddito netto RN prodotto in un anno viene rapportato ai mezzi propri MP. Using an ROI formula an investor can separate low-performing investments from high-performing investments.

With this approach investors and portfolio managers can attempt to optimize their investments. HMCNYSE announced its Consolidated Financial Summary for the Fiscal 1st Quarter Ended June 30 2022 and Forecasts for the Fiscal Year Ending March 31 2023. Allows the reader to calculate the present-day value of an investment based on inflation-adjusted projections of its future earnings.

Abbott Laboratories together with its subsidiaries discovers develops manufactures and sells health care products worldwide. Retirement of Bond Problems On January 1 2020 High Shots issued 250000 of 11 ten-year bonds at 104. ROI Net Profit Cost of Investment x 100.

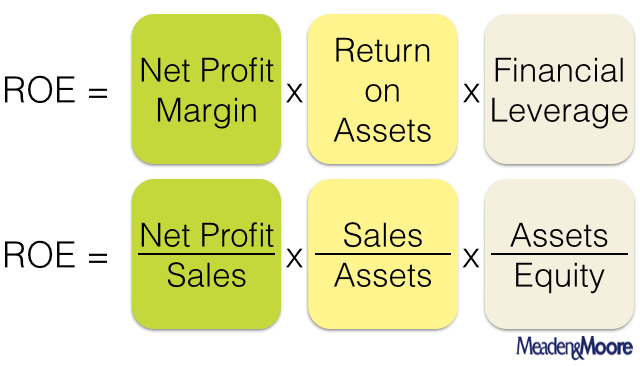

DuPont analysis also known as the DuPont identity DuPont equation DuPont framework DuPont model or the DuPont method is an expression which breaks ROE return on equity into three parts. Benefits of the ROI Formula. Definition of Ratio Analysis.

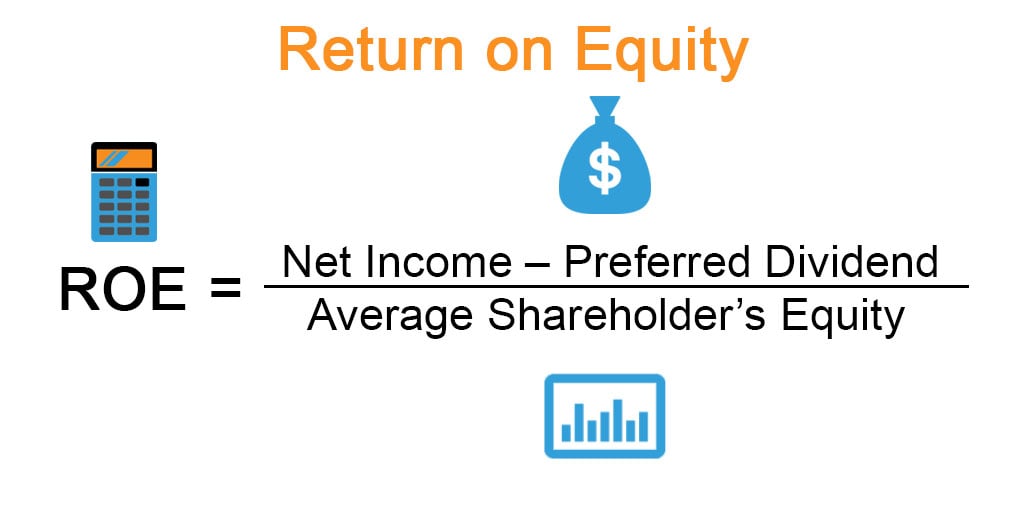

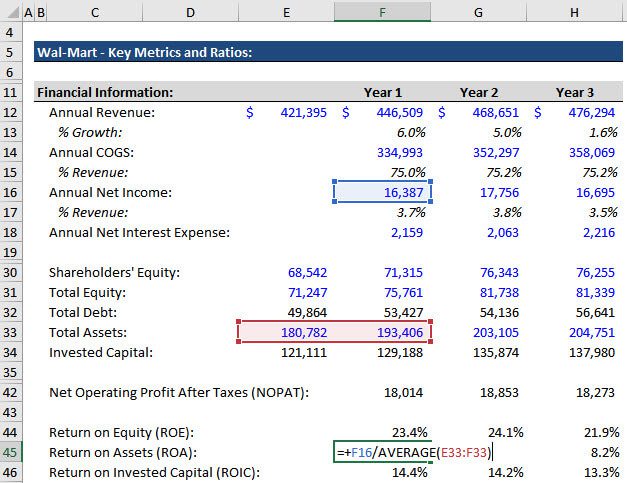

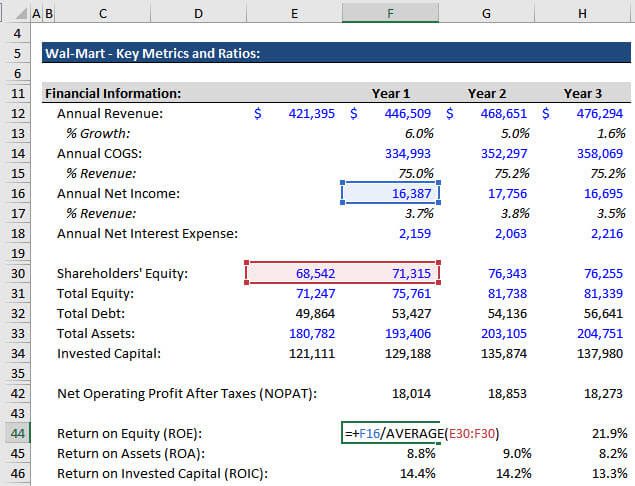

Return on equity ROE Net income Average total shareholders equity Profitability of all equity investors investment Benchmark. Return on assets ROA is a measure of how efficiently a company uses the assets it owns to generate profits. These two ratios dont take into account the timing of cash flows and.

ROI so you can use this return on equity calculator or a ROI calculator with. Please show the spreadsheet formula. Established Pharmaceutical Products Diagnostic Products Nutritional Products and Medical Devices.

Net Present Value NPV. Relación deuda patrimonio 14. Assim como o ROE o ROI também não deve ser analisado isoladamente e para que seja possível comparar duas empresas que seja em uma mesma unidade de valor e espaço de tempo.

O que é ROIC. Return On Invested Capital - ROIC. DuPont explosives salesman Donaldson Brown invented the formula in an internal efficiency.

Return on Assets ROA. In finanza aziendale il return on common equity ROE è un indice di redditività del capitale proprioCostituisce uno degli indici più sintetici dei risultati economici dellazienda. ROE and Return on Assets ROA.

The formula for ROE used in our return on equity calculator is simple. Profitability ratios are a class of financial metrics that are used to assess a businesss ability to generate earnings compared to its expenses and other relevant costs incurred during a specific. It operates in four segments.

Growth Stock vs Value Stock. A calculation used to assess a companys efficiency at allocating the capital under its control to profitable investments. How to calculate ROI Return on Investment Calculating annualized return.

Il capitale netto o capitale proprio dellesercizio T-1 ossia alla condizione di. Cas Please show the spreadsheet formula. Sometimes called return on investment ROI.

Ratio analysis can be defined as the process of ascertaining the financial ratios that are used for indicating the ongoing financial performance of a company using a few types of ratios such as liquidity profitability activity debt market solvency efficiency and coverage ratios and few examples of such ratios are return on equity current ratio quick ratio. Coupon Rate vs Interest Rate. Accounting fundamentals 658 Asset Management Tutorial 198 Banking 44 Credit Research Fundamentals 6 Economics 44 Finance Formula 382 Financial Modeling in Excel 13 Investment Banking Basics.

The name comes from the DuPont company that began using this formula in the 1920s. Future Value on a Single Sum Title 1 2 3. It is closely related to measures like return on assets ROA and return on equity ROE.

Return on Equity. Stock Dividend vs Stock Split. The more diverse these are the more you need to consider other metrics on top of calculating ROA.

Its calculated by dividing the ROI by the number of years the investment is held. Here are two ways to represent this formula. ROE ROI ROIC ROA e WACC.

Managers analysts and investors use ROA to evaluate a companys financial health. EB Cost of equity capital PG HA Return on assets ROA Net Income Interest expense 1-tax rate Average total assets Overall profitability of assets. Se considera que mide la rentabilidad empresarial mejor que la rentabilidad sobre los recursos propios ROE porque tiene en cuenta todos los recursos que utiliza la empresa tanto los propios como los ajenos.

Conheça alguns dos principais fundamentos para analisar uma empresa. Rentabilidad sobre los fondos propios ROE 13. Still a common shortcut is to compare a companys performance to the long.

Return on invested capital gives a.

Return On Equity Roe Definition Formula Seeking Alpha

Dupont Analysis Formula Breakdown And Excel Calculator

Return On Assets Roa Formula Calculation And Examples

Return On Equity Roe Formula Examples And Guide To Roe

Roa Return On Assets Accounting Kpi Billwerk Wiki

How To Calculate Return On Equity Roe With The Dupont Formula Meaden Moore

Beginners Guide To Returns Roe Roa Roi R Doctorstock

Beginners Guide To Returns Roe Roa Roi R Doctorstock

Return On Equity Examples Advantages And Limitations Of Roe

Roi Vs Roe All You Need To Know

What Is Roa And How To Calculate It

Weighted Average Cost Of Capital Wacc Cost Of Capital Accounting And Finance Finance Investing

Return On Equity Roe Formula And Calculator Excel Template

Return On Equity Roe Formula And Calculator Excel Template

Roic Vs Roe And Roe Vs Roa Key Financial Metrics And Ratios

How To Calculate Return On Assets Roa

Roic Vs Roe And Roe Vs Roa Key Financial Metrics And Ratios